With more and more businesses going online and cybersecurity perils multiplying exponentially, risk management has become a digital security essential today. What’s this methodology all about, how can you minimize your attack surface, and is it enough as a stand-alone solution? Let’s learn more.

What is Risk Management?

Online businesses today are complex and dynamic ecosystems built with many third-party integrations. These external service providers often create a wide range of dependencies and vulnerabilities that traditional cybersecurity solutions simply can’t detect. Hackers and cybercriminals exploit this very fact, putting millions of personal records, private data, and sensitive databases at risk.

That’s exactly where Risk Management comes to the rescue. This end-to-end methodology scrutinizes the company’s infrastructure (servers, control rooms, computers, etc.) and also looks at the software side of things to make sure that everything is being monitored. Access control needs to be spot on to achieve sustainable compliance today and Risk Management helps with that.

So what is Risk Management all about?

- Identifying Risk – The first step involves a comprehensive evaluation of the organization’s environment to identify existing or potential security risks.

- Assessing Risk – Once the potential risks have been identified, you must understand how likely they are to impact your organization.

- Controlling Risk – Here you’ll be defining methods, procedures, and other measures that will help your organization mitigate these risks.

- Review Controls – The final part of the puzzle is the ongoing evaluation (and adjusting) of the security controls and measures that you have implemented.

Well-implemented Risk Management helps online businesses minimize Adversarial Threats (third-party vulnerabilities, privilege abuse, etc,), System Failure (database downtime, backup issues, etc.), and Human Error (social engineering hacks, etc.)

Top 5 Benefits of Risk Management

There are many Risk Management frameworks to guide you towards creating a stronger security posture that’s also compliant – NIST CSF, ISO 27001, and DoD RMF to name a few. Adhering to one or more of these is becoming increasingly important.

Here are 5 key benefits of having good Risk Management today:

1. Attack Surface Risk Reduction (Visualization)

As mentioned earlier in this article, your attack surface is often larger than your traditional AppSec toolkit can show you. For example, hackers may often exploit a service provider and then initiate a supply chain attack, like in the infamous SolarWinds case. Proper Risk Management helps you identify and classify all your digital assets (and dependencies) for better attack surface protection.

2. Third-Party Risk Management (TPRM)

With businesses looking to scale up faster, there are more and more blind spots being created by third-parties today. This is because these external applications often lead to fourth and fifth party dependencies that can be exploited. Think expired domains. Proper TPRM solutions can help you with risk score modeling and keep you aware of all potential threats your databases and networks are facing.

3. Compliance Benefits

Compliance goes way beyond the European GDPR today. US-based privacy laws are taking effect in multiple states and across multiple industries – The Health Insurance Portability and Accountability Act of 1996 (HIPAA) is one, while California has the California Consumer Privacy Act of 2018 (CCPA). Online businesses are being held liable for all data breaches and Risk Assessment is helping on this front as well.

4. Optimized Budgets and Resource Usage

Risk Assessment also helps security and IT teams plan better and optimize their money spending. There is no guesswork anymore, since there is more data available at any given time. Resource usage is also optimized thanks to the actionable insights, allowing organizations to scale up faster and focus on what matters most – core technology development and brand awareness campaigns.

5. Enhanced Transparency – Internal & External

The directly-involved stakeholders are better informed and the companies fare better in compliance audits with proper Risk Management implementation, but other departments also get to enjoy the transparency and shareable information. Escalations are faster and clearer, allowing all teams to share the burden and fasten remediation times, a crucial crisis management / damage control aspect today.

Related: Top 5 Cyber Threats to Expect in 2022

Mindaro: The Natural Risk Management Supplement

Unfortunately, like any security methodology or tool, implementing Risk Management is often not enough. Hackers do manage to slip through the cracks even with big companies like British Airways, Colonial Pipeline, Kaseya, Twitch, and the aforementioned SolarWinds. You also have Magecart and Web Skimming operations wreaking havoc on eCommerce and financial websites.

There are many weak points in even the most advanced Risk Management tools:

- Model Errors – There is always a margin for error with predictive models

- Incremental Failure – Small unnoticed problems can deteriorate fast

- Risk Ignorance – There can be a lack of onboarding or training

- No Real-Time Alerts – Some solutions don’t provide real-time monitoring

- Sudden Landscape Shifts – Reality is often unpredictable

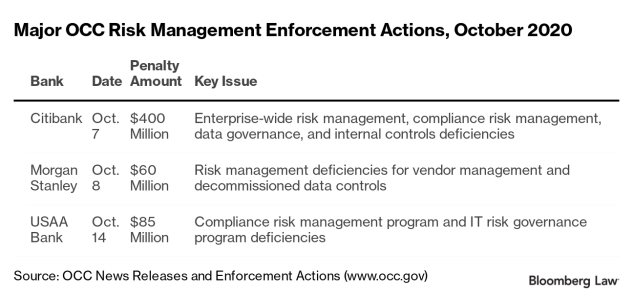

Not applying adequate Risk Management processes can prove to be very costly. Just a couple of years ago, the Office of the Comptroller of the Currency (OCC) took stern action against multiple banks due to Risk Management and compliance issues.

This is before we talk about the costs of data breaches and leaks. The global average cybercrime cost has already crossed the 6 trillion USD mark. Every exploited online business is looking at recovery expenses, regulatory fines, legal fees, and brand damage. This is why getting cyber insurance is seen as a natural add-on to any Risk Management solution. You can never be too safe today.

Mindaro is a true game changer in the cyber insurance space. It’s allowing online businesses from a wide range of sectors to lower cyber exposure, all with a simplified, transparent, and no-nonsense approach that has never been seen before.

Risk Management Isn’t a Silver Bullet